Micron Technology: From DRAM To Drama

Micron Technology (NASDAQ:MU) is a world leader in memory and semiconductor technologies. It offers many forms of semiconductor devices. For example, the firm develops and produces dynamic random access memory, flash memory and solid-state drives. Despite its wide range of products, a large part of its revenue comes from the DRAM segment. In fact, the dynamic random access memory account for about 60% of the company's total revenues.

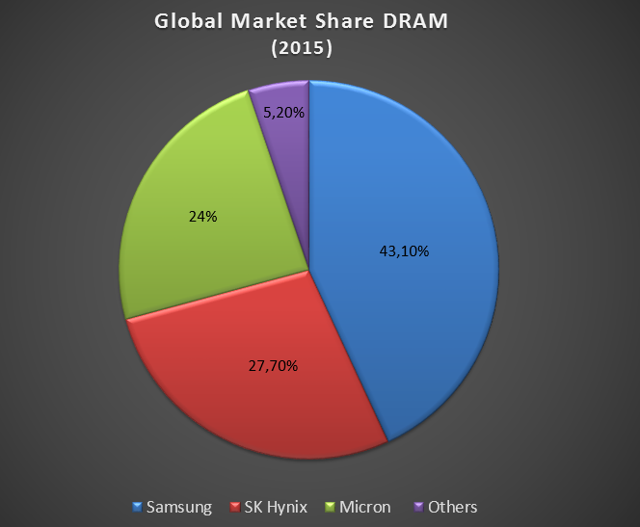

With the acquisition of Elpida Memory in 2013, Micron became a prominent player in this notoriously cyclical industry. Currently, Micron has a market share of approximately 24%. Consequently, it's the third biggest player in the DRAM industry. Samsung (OTC:SSNLF) is the leader with a market share of 43.1%. The second largest player is SK Hynix with a share or 27.7%. The balance is divided between a fairly large number of private companies. Kingston Technology is a good example.

(Source)

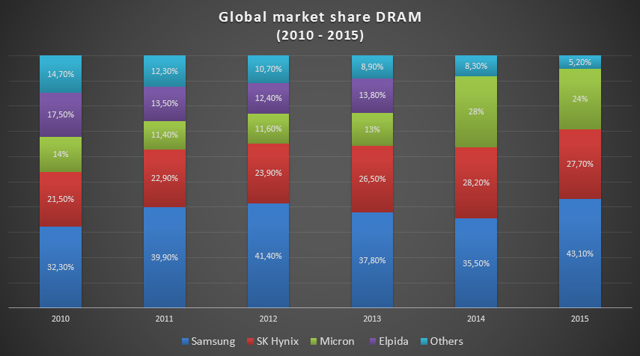

As the table above shows, the three biggest players control around 95% of the market. Clearly, it's a mature market and there's no room for consolidation. Back in 2010, the market share held by Samsung was equal to 32.3%. Five years later, it's equal to 43.1%. In my opinion, the South Korean multinational is the winner. The picture below illustrates variations in the global market share from 2010 to 2015.

(Source)

In fact, the DRAM market is more consolidated than ever. Consequently, the competition between the three dominant players is extremely fierce. If we combine this factor with a challenging DRAM pricing, it's easy to understand why the stock suffered. At the beginning of 2015, the stock was trading around $35. After a decline of more than 50%, it's possible to buy a participation in the corporation for less than $20.

Indeed, random access memory is cheaper than ever. Ironically, the demand is higher than ever. The number of devices utilizing DRAM has surged over the past years. However, the price has collapsed to historic lows. Evidently, the supply is the problem. To summarize, DRAM is pretty similar to coal. There is an excess of supply. On the other side, it's possible to see the light at the end of the tunnel.

But Samsung pulling back on capex and delaying 1x transition should allay fears of sustained oversupply in 2016 (Source)

Despite these negative aspects, I'm bullish on Micron Technology. Indeed, the firm continues to generate meaningful cash flows and it has a healthy balance sheet. With $8,596 million in current assets and $11.841 billion in total liabilities, I'm not worried at all about the solvency of the firm. It also is interesting to mention that it holds $3.521 billion in the kitty.

In my opinion, the actual price is an interesting entry point. Based on a discounted cash flow analysis, the risk/reward ratio seems asymmetric. The weak outlook for the DRAM market is clearly priced in.

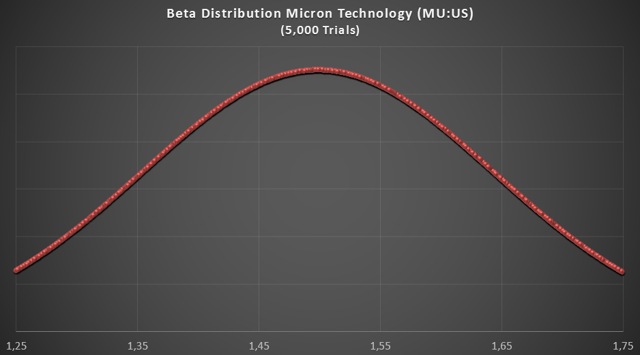

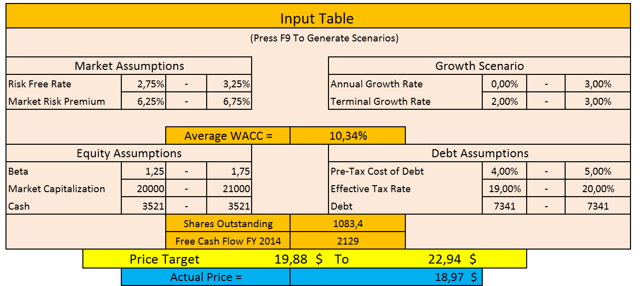

In my model, I considered a risk-free rate between 2.75% and 3.25%. Currently, the yield on a 30-year Treasury bill is around 2.89%. The range might look a bit high, but a rate hike is probable in the short term. I also used a market risk premium between 6.25% and 6.75%. Aswath Damodaran estimated the market risk premium at 6.63% for the month of October. So, my range reflects the reality in my mind. I also used a beta distributed normally between 1.25 and 1.75. The following graph illustrates the situation based on 5,000 scenarios.

Based on these inputs and on 5,000 scenarios, the average WACC is 10.34%. In my mind, it's pretty high and it's certainly not over-optimistic. The complete inputs table is illustrated below.

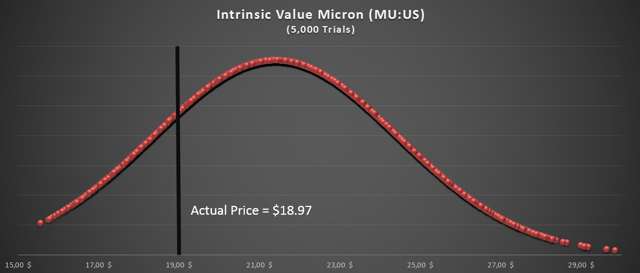

According to my model, Micron Technology looks slightly undervalued at $19. Based on my calculations, the intrinsic value is between $19.88 and $22.94. My lower estimate was calculated by subtracting one-half of the standard deviation to the mean (Mean - 0.5 x S.D). The upper estimate was calculated with the same methodology (Mean + 0.5 x S.D). The complete intrinsic value distribution is represented by the graph below.

In brief, the current price of approximately $19 looks like an interesting entry point. Despite the difficult environment in the DRAM industry, Micron continues to generate important cash flow. The corporation also has a strong balance sheet with a significant cash balance.

The results of my discounted cash flow model are corroborated by a relatively low forward price to earnings ratio. The trailing 12-month diluted EPS is equal to $2.49. In my opinion, it's trivial. The price of the DRAM is significantly lower than one year ago. So, the earnings forecast are more meaningful.

For the full-year of 2016, the consensus EPS forecast is $1.55. Over the last four weeks, it had 15 down revisions. So, all the negative aspects are already priced in. Based on a current price of $19, the FY 2016 P/E is equal to 12.25 and the FY 2017 P/E is equal to 7.63. Without a doubt, it's more than reasonable.

Furthermore, the company is reportedly engaged in merger and acquisition discussions. I would be pleased to see a deal. Indeed, it's useless to have $3.5 billion in the kitty. With the actual interest rate, the money only generates minor interest income. An acquisition also will allow Micron to diversify its income stream. As I said earlier, around 60% of its revenue comes from the DRAM market.

In the actual market, debt is much cheaper than equity and it's not big news. With its strong balance sheet, Micron is able to support a higher level of debt. It would result in a lower weighted average cost of capital and ultimately in a higher valuation. In my model, I used an after-tax cost of debt of 3.63% vs. a cost of equity of 12.75%. In brief, an acquisition will unlock a lot a value by diversifying the revenue stream and by diminishing the WACC.

In conclusion, Micron Technology operates in a competitive industry with a bleak outlook. However, the corporation is well positioned to weather the storm with its strong balance sheet and its important cash flow. Moreover, the current downturn could be beneficial for the firm due to acquisition opportunities. If Micron is able to reach a deal, it would result in a higher stock price in my opinion.

On the other hand, I'm an undergraduate student, not a professional. Please take this factor into account. Despite the bullish tone of my article, please do your own due diligence and consult your financial advisor before taking any action. I am not a financial advisor.

The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.